In light of International Women’s Day and inspiring inclusion, we want to shine a light on the area of wealth and money. For too long the gender pay gap, breaks in work for family and many other disruptions can impact a woman’s financial capacity. It’s time that we open the conversation and create our own way to forge financial independence.

Residential real estate is a significant contributor to the wealth of Australians and has become an integral part of retirement planning. Owning a home outright can significantly increase the likelihood of a comfortable retirement by eliminating housing costs during a time when income is likely to reduce. However, this means that one needs to get onto the property ladder to achieve this goal. Unfortunately, homeownership is not equally accessible to all Australians.

The wage gap is sitting at 12, which means that for every dollar a man would earn, a woman typically earns 88c. It’s no wonder why women face challenges when saving their deposits for a home or investment property.

According to the latest ‘Women and Property’ report by CoreLogic released in March 2024, there is a significant gap between the homeownership structures of men and women in Australia. The report highlights that the biggest challenge for those who do not own a home is affordability. This is a more significant issue for women, where 57.6 of women report that they do not have enough savings to cover upfront costs (such as a deposit, stamp duty, and other transaction costs), compared to 41.8 of men who face the same challenge.

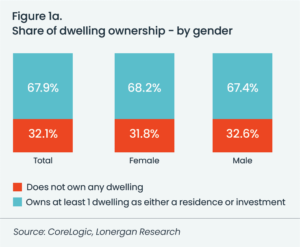

The report has a promising finding, where 68.2 of women own at least one residential property, either as their primary residence or as an investment property. This percentage is only slightly higher than that of men, with 67.4. In other words, there is less than a one percent difference in property ownership between the two cohorts. (Figure 1a below)

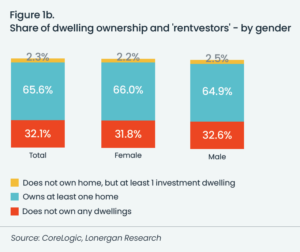

Interestingly, the report revealed that 66.0 of women owned their homes, and 2.2 did not, but had at least one investment property. Compared to men, 64.9 owned their homes, while a further 2.5 did not, but owned at least one investment property. (Figure 1b below)

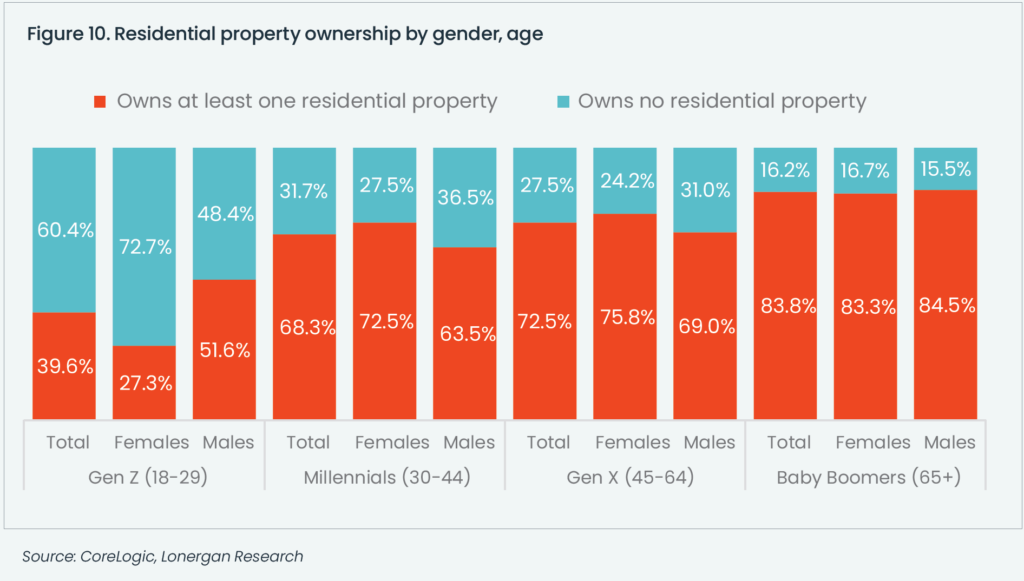

There is also a big difference when it comes to generation ownership. Although men and women have a fairly equal share in residential ownership overall, the biggest discrepancy is among Gen Z (aged 18 to 29). Only 27.3 of women in this cohort identified as owning a residential property as an investment or home, compared to 51.6 of men.

Breaking it down by age group, there is a significant gap in ownership of property between young women and men. To understand the reasons behind this gap, Gen Z women were asked why they didn’t own property – 61.4 of them said that they didn’t have enough savings to cover the upfront costs. However, only 25.1 of men in the same age group identified this as the issue.

The percentage of women who own at least one residential property is high across generations, with 72.5 for Millennials (aged 30-44), 75.8 for Gen X (45-64), and 83.3 for Baby Boomers (65+). (Figure 10 below)

Young women face affordability challenges and income discrepancies compared to men in Gen Z. More than half of women in Gen Z earn less than $70,000 per year, compared to men who have a higher concentration of earnings between $70,000 and $100,000.

Now, this is a very high-level overview of some of the findings.

It is daunting to realise that property has doubled twice while average wages have only doubled once. It is about getting your foot in the market and then growing from there. Little steps now will make huge differences in the future.

How you get started.

Our message for Women and Property is to break the larger goal into smaller steps, so it’s manageable and achievable. What’s important is that you need to start, whether that means planning or actually executing your strategy, it’s time to start taking control of your financial future.

Here are 5 key tips to getting started:

1. Be mindful of your money. Managing your finances and keeping track of your income and expenses is crucial when it comes to setting targets and building a deposit for your investment property. In today’s economic state, it can be challenging to make ends meet, especially due to the high cost of living. That’s why many families nowadays have both parents working to manage their finances effectively.

2. Setting clear goals. Some people want to buy their first home, but if they are unable to do so after some time, they start considering alternative approaches. It’s essential to have a clear understanding of what you’re trying to accomplish and the timeline for achieving that objective.

3. Building your dream team. It’s important to recognise that you can’t purchase a property all by yourself. Each residential property is unique, so it’s essential to surround yourself with individuals who are knowledgeable and helpful, with good intentions. These people can assist you in navigating the various challenges that may arise, such as changes in the environment, legislation, and lending policies.

From a mortgage broker’s perspective, a good broker understands the investing structures, including property protection and portfolio optimisation. Likewise, an accountant can provide valuable insights beyond taxes, advising on when to buy or sell.

4. The property search. It ultimately depends on your specific situation as to where, what, and why you should invest. Your goals, priorities, financial situation, and investment criteria should guide you in determining where to start looking. For instance, if you require a higher cash flow, then it is advisable to invest in a place that offers a higher yield. Vibrant employment and business opportunities attract people to move, along with the supply and demand balance.

5. Maximising your returns. Every type of investment property has its advantages and challenges. If you have a good stream of tenants or demand in the right area but not enough supply, it puts you in a good position. For instance, if an area has only one or two years of supply left, then you can expect an increase in property value and rent due to appreciation.

Once you have invested in a property, success will depend on having a competent team to manage it effectively. A good property manager should prioritise good communication and keep you updated on maintenance and renovation needs. They should conduct regular inspections and address any issues that arise promptly. You should discuss with your property manager the potential impact of rent increases on your tenants and how long it may take to find a new tenant if necessary. It’s important to maintain open and ongoing communication with your property manager to ensure the smooth operation of your property.

The real estate industry has been largely dominated by men; however, it is important to have more representation of women in this field using property investment as a means to achieve financial freedom. The key is to start by getting into the market and then gradually expanding from there.

Savvy property investors focus on acquiring properties and holding them as property is a long-term investment. In the world of investing, it is said that “time in the market is more important than timing the market.”

To help you get started, have a chat with a friendly API Property Consultant by clicking on the ‘Start here’ button or this link: https://activepropertyinvesting.com.au/get-started/

Source: CoreLogic, Women and Property – Australia 2024